Remuneration Policy 2025

Approved at the AGM on 2 April 2025

1. Introduction

This is the remuneration policy (hereinafter “Remuneration Policy”) of Elisa Corporation (“Elisa”), which complies with legislation and the Finnish Corporate Governance Code. This Remuneration Policy sets out the principles for the remuneration of the Board of Directors, and of the CEO and any potential Deputy CEO (hereinafter “CEO”).

Shareholder consultation and key changes in Remuneration Policy

At the 2024 AGM of Elisa Corporation, the 2024 Remuneration Policy was not approved, with a minority of 45.35% of votes cast in favour. The decision of the AGM was advisory.

Following the AGM, Elisa has undertaken an extensive review to understand the concerns and views of shareholders and shareholder representative bodies. Elisa has carefully considered all the feedback received to develop the 2025 Remuneration Policy, which will be presented at the 2025 AGM.

The main changes in the Remuneration Policy compared to the 2024 policy are in response to the feedback received from shareholders and shareholder representative bodies:

• The maximum STI is capped, and the maximum STI as a percentage of the fixed salary is included in the policy.

• The maximum LTI is capped, and the maximum LTI as a percentage of the fixed salary is included in the policy.

• The policy clarifies that the performance period for the performance share plan is not less than three years.

• The policy clearly specifies the amount of severance pay: the CEO is entitled to receive severance pay equal to the total salary for18 months, less the salary for the period of notice.

We would like to thank all the shareholders and representative bodies for their input, and we continue to be committed to ongoing and open dialogue with our shareholders.

2. Description of governance and decision-making process

Preparation and Approval

The Remuneration Policy and any possible substantial changes to it are prepared by the People and Compensation Committee of the Board of Directors of Elisa or by another equivalent governing body to which preparation of remuneration matters is directed (hereinafter the “People and Compensation Committee”). The People and Compensation Committee hears the views of the Shareholders’ Nomination Board on the Remuneration Policy related to the Board of Directors.

The Board of Directors reviews and presents to the General Meeting the Remuneration Policy and any substantial changes to it whenever necessary, but at least every four years. The General Meeting votes on an advisory resolution on the Remuneration Policy, expressing whether it supports the Remuneration Policy as presented. If a majority of the General Meeting opposes the Remuneration Policy as presented, a revised Remuneration Policy will be presented no later than at the subsequent General Meeting.

The Board of Directors of Elisa decides on the remuneration of the CEO in accordance with the Remuneration Policy. Where necessary, the People and Compensation Committee prepares matters relating to remuneration with the assistance of independent external experts. Decisions concerning distribution of shares, options or other special rights entitling the holder to shares are made at the General Meeting or by the company’s Board of Directors pursuant to an authorisation from the General Meeting. When shares, options or other special rights entitling the holder to shares are issued to the CEO as part of their remuneration, this must take place within the limits of the Remuneration Policy.

Monitoring

The People and Compensation Committee of the Board of Directors of Elisa annually monitors the implementation of the Remuneration Policy and, where necessary, presents to the Board of Directors measures for ensuring its implementation. To enable shareholders to evaluate the implementation of the Remuneration Policy at Elisa, the Board of Directors annually presents to the Annual General Meeting a Remuneration Report prepared by the People and Compensation Committee. The General Meeting decides whether to approve the Report. The decision is advisory.

Conflicts of interest

Issues relating to conflicts of interest regarding remuneration have been taken into account. The Shareholders’ Nomination Board, consisting of representatives of the biggest shareholders and established by the General Meeting of Elisa, makes a proposal to the General Meeting on the remuneration of the Board of Directors. The Chair of Elisa’s Board of Directors, who also is a member of the Shareholders’ Nomination Board, does not participate in the decision-making for the remuneration proposal for the Board of Directors at the meeting of the Shareholders’ Nomination Board. The General Meeting decides on the remuneration of the Board of Directors.

The Remuneration of the CEO is prepared by the People and Compensation Committee and decided by the Board of Directors of Elisa. The CEO is not a member of these bodies and is not involved in the decision-making process regarding his or her remuneration.

3. Remuneration principles

Remuneration promotes Elisa’s business strategy and long-term financial success as well as the favourable development of shareholder value with the following Elisa remuneration principles:

• Pay for performance is Elisa’s main principle for remuneration. Elisa acknowledges and rewards good and sustainable performance and achievements that are in line with Elisa’s strategy and strives to establish a clear link between the company’s and employees’ performance and success. Further, Elisa ensures that the personnel understand how they can impact the company’s results.

• Competitive, market-driven and fair remuneration that enhances commitment ensures that Elisa can attract, motivate and retain the best employees. Remuneration benchmarks are regularly conducted against relevant geographic and industrial markets.

Effective communication of the remuneration principles and programmes ensures transparency internally and externally. Remuneration principles and programmes are communicated to employees and external stakeholders. Compliance with local laws and regulations and with Elisa’s remuneration principles is a perquisite for remuneration at Elisa. Internal controls have been implemented to ensure compliance.

Remuneration of Elisa’s personnel (including the CEO) is based on total remuneration, which may, among other things, include both variable and fixed components as well as personnel benefits. The personnel are mainly subject to a performance-based remuneration scheme. In addition, Elisa’s personnel, as a rule, are part of a long-term remuneration scheme, such as a personnel fund or a share-based remuneration scheme.

The terms and conditions of employment relationships of the broader employee population (particularly with respect to remuneration) have been taken into account when drawing up this Remuneration Policy. The remuneration of the CEO is more focused on variable components of remuneration than the broader employee population. The aim of variable remuneration is to steer the CEO and the personnel towards the same objectives.

Although the Board of Directors is not covered by the same overall remuneration as the personnel, the purpose of the remuneration of the Board is also to steer its activities towards the same long-term objectives of the company. The remuneration of the personnel, the CEO and the Board of Directors is regularly evaluated in relation to general market practices for persons acting in equivalent positions.

The Remuneration Policy supports the execution of Elisa’s strategy, is anchored to ambitious and sustainable targets, and takes into account all of our stakeholders. Remuneration structures are designed with appropriate consideration of the views and interests of stakeholders.

4. Description of the remuneration of the Board of Directors

On the basis of a proposal prepared by the Shareholders’ Nomination Board, the General Meeting annually decides on the remuneration of the Board of Directors. The decision on the remuneration of directors shall be in line with the remuneration policy presented to the General Meeting.

The remuneration of the Board of Directors may consist of one or more components. The Directors may, for example, be paid an annual or monthly fee as well as a meeting fee for attending Board meetings, committee meetings or other governing body meetings. The fees to be paid to Directors may be paid in cash and/or partially or entirely in shares. In its decision, the General Meeting may require that rewards to be paid in cash must be used partially or entirely in order to acquire Elisa shares.

Remuneration paid in shares may be subject to restrictions or recommendations related to lock-up periods concerning time or Board membership. In its proposal, the Shareholders’ Nomination Board may also require that a director is a shareholder in the company. The remuneration of the Board of Directors is not linked to any performance criteria. If a director has an employment relationship or service contract with the company, he or she will be paid a normal salary. The General Meeting will decide on any possible compensation to be paid to him or her for work done with the Board.

5. Description of the remuneration of the CEO

When deciding on the remuneration of the When deciding on the remuneration of the CEO, the starting point for the review is always total remuneration.

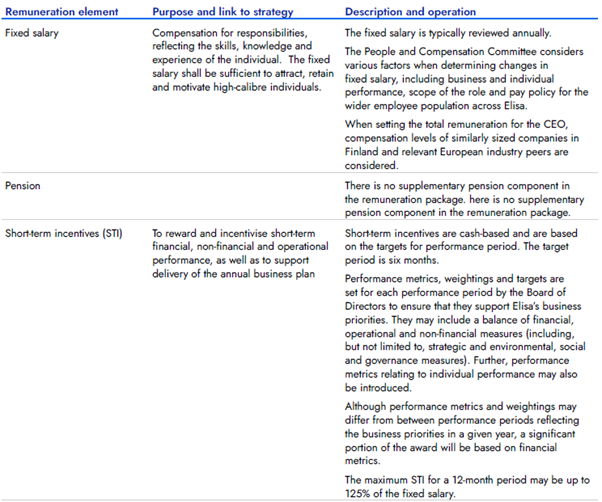

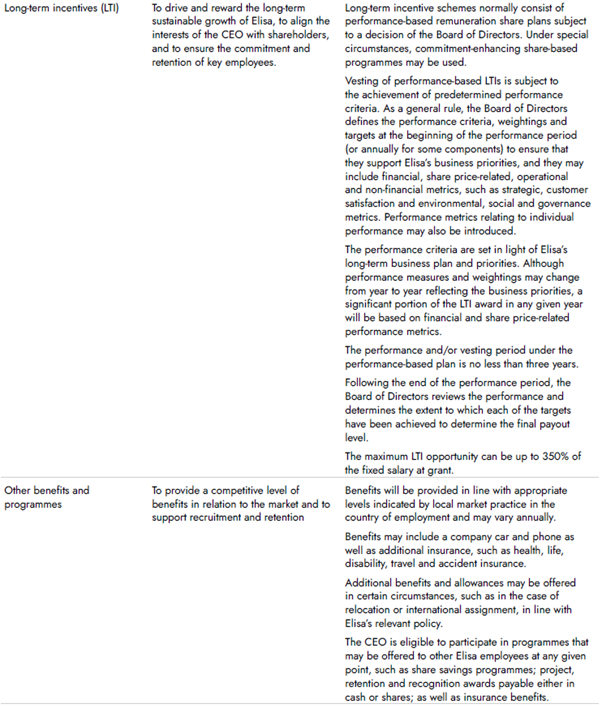

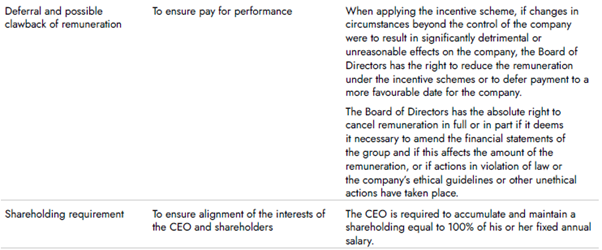

The CEO’s total remuneration may include a fixed salary, short- and long-term incentive schemes, and any possible taxable fringe benefits. Holidays, holiday pay, sick leave and other similar terms and conditions may be reviewed in accordance with the company’s standard policy and local legislation. In addition, insurance coverage and pension schemes may be agreed.

6. Service agreements and termination provisions

The terms of the CEO’s service agreement shall be specified in writing and approved by the Board of Directors. The terms specify the elements of the remuneration, as well as payments upon termination of service.

The CEO’s service agreement is typically until further notice, but it can also be in force for a specific fixed period.

The notice period of the CEO’s service agreement is determined so that it is in line with the market practice existing at the time that the service agreement is entered into.

The period of notice applicable to the CEO’s current service contract is six months for both parties. Should the contract be terminated by Elisa, the CEO is entitled to receive severance pay equal to the total salary for 18 months, less the salary for the period of notice.

7. Principles for new hires

Elisa’s policy on recruitment is to offer a compensation package that is sufficient to attract, retain and motivate individuals with the right skills for the required role. When determining remuneration for a new CEO, the Board of Directors will, upon the recommendation of the People and Compensation Committee, consider the requirements of the role, the needs of the business, the relevant skills and experience of the individual, and the relevant external market for talent.

Where an individual is recruited externally for the position of CEO, the Board of Directors will consider the remuneration package of that individual in their previous role. Generally, the Board of Directors will seek to minimise the use of any new hire arrangements and to align the new CEO’s remuneration with the Remuneration Policy. On occasions when it is deemed necessary and on a case-by-case basis, Elisa may make one-off awards to compensate the selected person for remuneration that the person received prior to joining Elisa but that lapsed upon the person leaving their previous employer, or as an incentive to join Elisa. The rationale for and details of any such arrangement made either in shares or cash will be disclosed in the Remuneration Report.

Where an individual is appointed to the position of CEO as a result of internal promotion or following a corporate transaction (e.g. an acquisition), the Board of Directors retains the opportunity to honour any legally binding legacy arrangements agreed prior to the individual’s appointment.

Where necessary, additional benefits – such as relocation support, expatriate allowance, tax equalisation and other benefits that reflect local market practice and relevant legislation – may also be provided.

8. Deviations from and amendments to the Remuneration Policy

Deviations from the Remuneration Policy

The remuneration of the CEO will be within the limits of the Policy presented to the AGM every four years. However, the Board of Directors may, upon the recommendation of the People and Compensation Committee, temporarily deviate from the Policy in whole or in part at its full discretion, in the circumstances described below:

• Upon a change of CEO (if applicable)

• Upon the appointment of an interim CEO

• Upon material changes in Elisa’s structure, organisation, ownership or business (for example a merger, demerger or acquisition) that could require adjustments to STI and LTI plans or other remuneration elements to ensure the continuity of management

• Upon a material change in the Group’s financial position, strategy or governance structure

• Upon a change in relevant legislation

• If another significant and justified reason for adjusting the remuneration of the incumbent CEO applies

• In any other circumstance where such a deviation may be required to serve the long-term interests and sustainability of Elisa as a whole or to ensure its viability

If any deviation from the Policy is applied, the company will disclose said deviation in the Remuneration Report for the year in question. If the company considers the deviation from the Policy to have continued to the point that it can no longer be deemed temporary, the company will prepare a new Remuneration Policy to be presented at the next General Meeting.

The deviation may apply to all reward components. The General Meeting decides on deviations in respect of remuneration of the Board of Directors, and the Board of Directors of Elisa decides on deviations in respect of the CEO.

Amendments to the Remuneration Policy

Substantial changes to the Remuneration Policy are prepared and presented to the General Meeting in accordance with the decision-making process described in section 2. In addition, Elisa may make changes that are not deemed material without presenting the amended Remuneration Policy to the General Meeting. Such changes include, for example, technical changes to the decision-making process for remuneration or to the terminology concerning remuneration. A change in legislation could also constitute grounds to make changes to the Remuneration Policy that would not be deemed material.

Elisa’s Board of Directors evaluates the need for changes in the Remuneration Policy. Elisa considers on a case-by-case basis the degree to which the drafting of the new Remuneration Policy is affected by the resolution of the General Meeting on the previous Remuneration Policy, or by shareholder statements about remuneration reports provided after the adoption of the Remuneration Policy and presented at a General Meeting.